Flipkart Big Billion Days vs Amazon Great Indian Festival 2025: The Ultimate Guide to India’s Biggest Festive Sale War

Introduction: India’s Festive E-Commerce Battle Unveiled

India’s e-commerce arena comes alive each September-October as two giants—Flipkart’s Big Billion Days and Amazon’s Great Indian Festival—compete intensely to capture hearts and wallets. These legendary sales have evolved into cultural phenomena, offering unbeatable deals, exclusive bank discounts, early access benefits, and driving the largest online shopping sprees of the year. Whether searching for the best smartphone deals, top fashion discounts, or wanting to understand the market shifts and shopping tips, this blog provides a deep dive for every search intent—from comparison, offers, dates, and user experiences to retailer strategies and future trends.

Table of Contents

- History and Evolution of India’s Festive Sales

- 2025 Sale Dates, Early Access, and Timeline

- Market Share: Flipkart vs Amazon India

- Category-Wise Offers & Product Highlights

- Bank Discounts, Payment Options & Card Offers

- Membership Programs: Early Access and Benefits

- Shopping Trends & Consumer Behavior

- Tier-2 & Tier-3 City Growth: The New E-Commerce Frontier

- Logistics, Technology, and Innovations

- SEO Strategies & Keyword Optimization for 2025 Sales

- Seller and Consumer Tips for Festive Shopping

- Economic Impact: Job Creation & MSME Empowerment

- Comparison Table: Flipkart Big Billion Days vs Amazon Great Indian Festival

- FAQ Section

- Call to Action

The Evolution and History of India’s Festive E-commerce Wars

Flipkart’s Big Billion Days: From Disaster to Dominance

Flipkart pioneered the concept of mega e-commerce sales in India with the launch of Big Billion Days on October 6, 2014. Despite initial technical challenges and inventory shortages that led to customer backlash, the sale fundamentally changed how Indians perceive online shopping. The company’s transparent apology and commitment to improvement transformed what could have been a brand disaster into a learning opportunity.

Since its rocky start, Big Billion Days has evolved into a meticulously planned 15-day extravaganza. The 2025 edition, marking the 12th iteration of the sale, is expected to start around September 15th and run until September 30th. Flipkart has consistently refined its approach, moving from a single-day event to an extended festival that accommodates India’s diverse shopping patterns.

Amazon’s Great Indian Festival: Global Expertise Meets Local Markets

Amazon entered India’s festive sales arena with the Great Indian Festival, leveraging its global e-commerce expertise while adapting to local market dynamics. The sale typically coincides with the Diwali season, running for approximately one month compared to Flipkart’s week-long intensive approach.

Amazon’s 2025 Great Indian Festival is confirmed to begin on September 23rd, with Prime members receiving 24-hour early access starting September 22nd. This strategic timing allows Amazon to capture both early festive shoppers and extend the shopping momentum through Diwali celebrations.

2025 Sale Dates, Early Access, and Timeline

Flipkart Big Billion Days 2025

- Start Date: Expected around September 15, 2025

- Duration: 16 days, ending September 30

- Early Access: Flipkart Plus, Premium, and Black members (24 hours early)

- Early Bird Deals: Category-wise offers begin September 8

Amazon Great Indian Festival 2025

- Start Date: September 23, 2025

- Duration: Month-long, runs up to Diwali

- Prime Early Access: September 22, 2025 (24 hours early for Prime subscribers)

- Pre-sale: Teaser deals, quizzes, and microsites live before launch

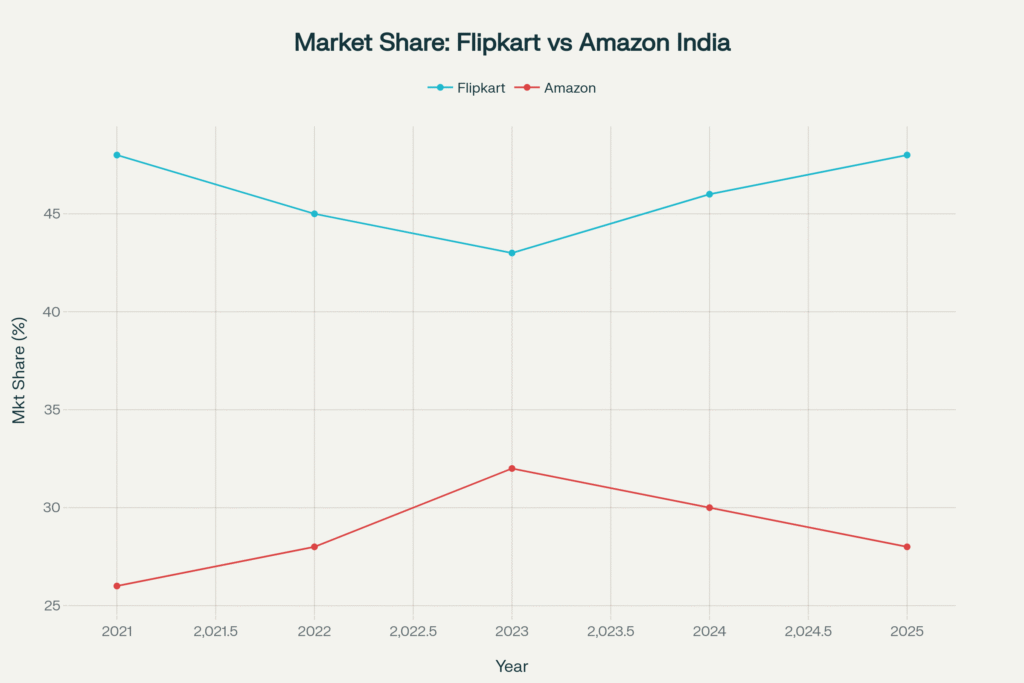

Market Share: Flipkart vs Amazon India

Flipkart holds a strong lead in Indian market share, especially during the festive period. The numbers in 2025:

- Flipkart: 48%

- Amazon: 28%

- Consistent competition, with Flipkart maintaining dominance through local focus and regional curation.

Category-Wise Offerings and Deals Structure

Mobile Phones and Electronics

Both platforms offer their most aggressive discounts on smartphones, with expectations of 40-85% off on popular brands. The iPhone 16 series is expected to see significant price drops on both platforms, with Flipkart potentially offering prices around ₹50,000. Samsung Galaxy S24, OnePlus devices, and other flagship smartphones will feature prominently in both sales.

Fashion and Lifestyle

Flipkart has historically maintained an edge in the fashion category, with its subsidiary Myntra leading the online fashion space. Both platforms offer up to 80% discounts on clothing, footwear, and accessories. Regional preferences and cultural sensitivity in product curation give Flipkart an advantage in this category.

Electronics and Appliances

From laptops and televisions to home appliances, both platforms offer substantial discounts reaching up to 80%. Smart TVs, washing machines, refrigerators, and kitchen appliances see some of the highest demand during these sales.

Home and Kitchen

This category has seen explosive growth, particularly in tier-2 and tier-3 cities where consumers are upgrading their lifestyle. Products range from basic kitchen essentials starting at ₹49 to premium home automation systems.

Bank Discounts, Payment Options & Card Offers

Flipkart Partnerships

- Axis Bank and ICICI Bank: 10% instant discount, capped up to ₹5,000

- Flipkart Axis Bank Card: Extra 5% unlimited cashback

- EMI and no-cost EMI on major banks

Amazon Partnerships

- SBI Credit/Debit Cards: 10% instant savings

- Amazon Pay: Wallet cashback, UPI rewards, and bonus offers

- Extended EMI plans and special pre-approval offers

Membership Programs: Early Access and Benefits

Flipkart Plus and Premium

- 4 successful transactions unlock Plus; 8 for Premium

- 1–2 SuperCoins per ₹100 spent

- Flipkart Black: Paid membership for max savings, early access, and bundled subscriptions

Amazon Prime

- 24-hour early access to deals

- Faster shipping, Prime Video, Prime Music

- Prime orders delivered in 48 hours or less

Shopping Trends & Consumer Behavior

- 70% of festive sales happen via mobile apps

- Indian shoppers use price-tracking, wishlists, and time bank offers for highest savings

- Tier-2/3 cities contribute 60% of orders; metro-tiers are declining in share

- Voice search, vernacular language interface, and social commerce trending upwards

Tier-2 & Tier-3 City Growth: The New E-Commerce Frontier

India’s smaller towns and cities now dominate online orders, thanks to smartphone penetration, better logistics, and changing aspirations:

- Digital payments and UPI at all-time high adoption

- Festival sales drive first-time online purchases in these regions

- Regional language content, localized deals, and tailored delivery models

Logistics, Technology, and Innovations

- Flipkart and Amazon add >300,000 temporary staff for festive logistics

- Drone pilots and same-day delivery in major metros

- AI-powered merchandising, voice assistants, and AR shopping

- Multi-language support and gamified customer engagement

Seller and Consumer Tips for Festive Shopping

Shopping Checklist

- Create wishlists in advance

- Compare deals on both platforms

- Use early access via Prime/Plus memberships

- Maximize savings with bank offers and bundled deals

- Track flash sales and limited-time offers

Seller Success Strategies

- Prepare inventory via demand forecasting

- Optimize listings with festive keywords

- Partner with micro-influencers for local reach

- Use real-time dynamic pricing tools

- Offer bundle packs and limited editions

Economic Impact: Job Creation & MSME Empowerment

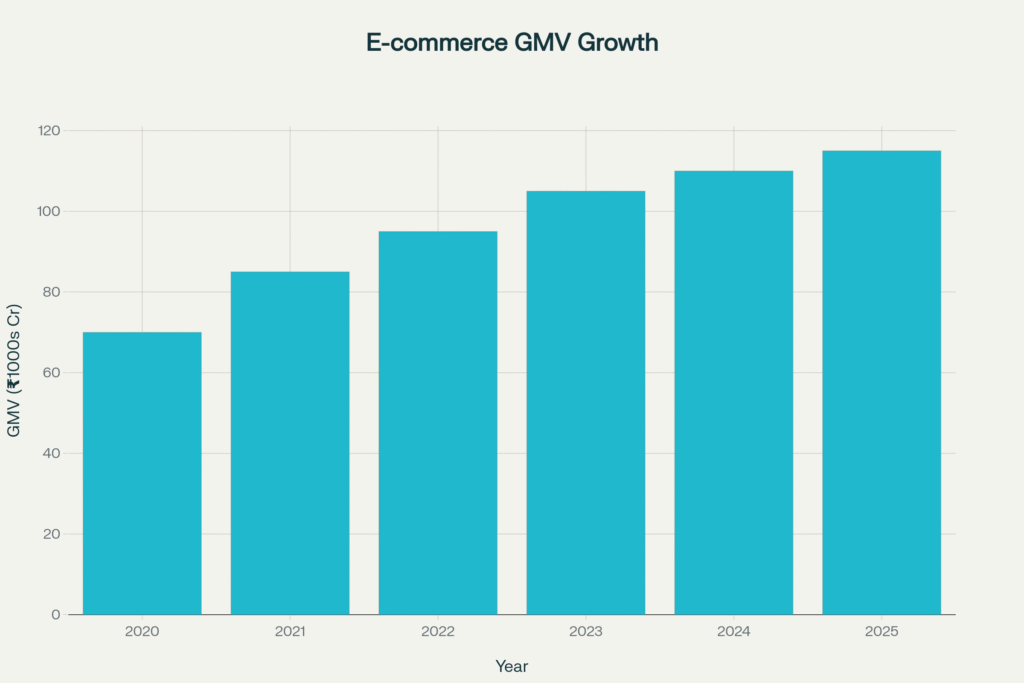

- Over ₹1.15 lakh crore GMV expected in 2025

- 300,000+ seasonal jobs created, from logistics to customer service

- MSMEs get a digital boost and expanded national reach

- Payment innovations drive cashless India, especially in new markets

Flipkart Big Billion Days vs Amazon Great Indian Festival: Quick Comparison

| Factor | Flipkart Big Billion Days | Amazon Great Indian Festival |

|---|---|---|

| Duration | 16 days | ~30 days (till Diwali) |

| Start Date (2025) | Sep 23 | Sep 23 (Prime early: Sep 22) |

| Category Focus | Mobiles, Fashion, Home | Electronics, Home, Lifestyle |

| Market Share | 48% | 28% |

| Early Access | Plus/Premium/Black | Prime |

| Main Bank Offer | Axis, ICICI | SBI |

| Mobile App % Orders | 70%+ | 70%+ |

| Tier-2/3 Orders Share | 60%+ | 60%+ |

Common Questions Answered

Q1: Which sale is better—Big Billion Days or Great Indian Festival?

Both sales offer aggressive pricing and deep bank deals. Flipkart excels in fashion, mobile deals, and regional curation, while Amazon is strong in electronics, home appliances, and Prime benefits. Compare specific products for the best savings.

Q2: How do I get early access to sale deals?

Early access is available via Flipkart Plus (free after qualifying transactions) and Flipkart Black (paid) for Big Billion Days, and Amazon Prime (paid) for Great Indian Festival.

Q3: What banks offer discounts on Flipkart and Amazon?

Flipkart ties up with Axis and ICICI; Amazon mainly partners with SBI. Each offers 10% instant savings, with caps per card/account.

Q4: Are more deals available for users in tier-2/3 cities?

Yes! Both companies now focus on smaller cities, with localized offers, improved logistics, and more language options than ever.

Q5: Which long-tail keywords should I target for festive shopping blogs/products?

Target keywords like “best iPhone deals Flipkart sale”, “Amazon Great Indian Festival fashion discounts”, “kitchen appliance offers Diwali 2025”, and “AXIS/ICICI/SBI card festive sale cashback” for strong SEO.

Ready for the biggest savings of the year?

Start building your wishlist now and compare deals from both Flipkart and Amazon. Leverage early access memberships, bank offers, and top product reviews on PreviewKart and Digehub to unlock maximum benefits. Don’t miss exclusive festive shopping hacks, price alerts, and e-commerce news—subscribe today for the latest updates!

Want to stay ahead in festive shopping and e-commerce trends? Visit PreviewKart for expert reviews and Digehub blog for deep-dive sale tactics and SEO strategies!